Hi Boon,

We have discussed coal a few times over recent weeks as the energy sector enjoys a resurgence albeit led by uranium and oil. Victoria’s electricity grid has recently experienced periods where demand exceeded 80% of its capacity, illustrating how much work is still needed to evolve away from coal. VIC is actively working towards its renewable energy targets, aiming for 65% by 2030 and 95% by 2035. However, without sufficient firm capacity, such as energy storage and fast-start gas plants, grid reliability this timeline could prove a pipedream.

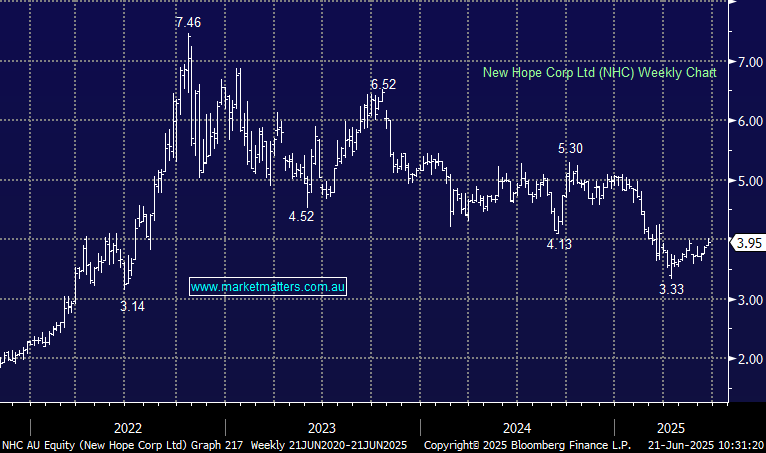

At MM while we believe in the transition away from fossil fuels is inevitable, it will take longer than many hope. While we are not expecting coal to scale the dizzy heights of 2022 a bounce back towards the mid-2024 levels feel likely, when NHC was trading above $5.

- We see coal prices improving moving forward with a test by NHC of $5 our preferred scenario through 2025/6.

The dividend is obviously a function of the underlying coal price, primarily thermal in the case of NHC, and if we are correct and things are close/or at their nadir then NHC can yield ~10% fully franked in the next 12-months. The consensus forecast for NHC dividends is 22c in October 25, and 19c in April 26, putting it on a yield of 10.38%.