Hi Peter,

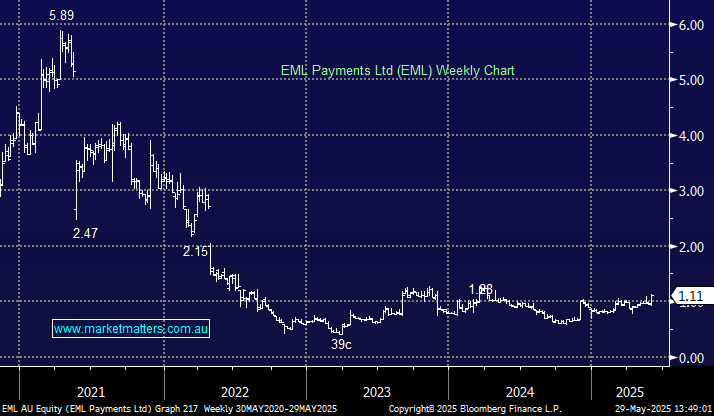

Things have been improving for EML, in FY24 total revenue increased by +18% year-over-year, reaching $217.3 million, driven by growth in both customer revenue and interest income. This dropped down to reduce its loss to $9.6mn, significantly better than the $217.3 in FY23. This has been an issue for the share price with global markets putting most tech stocks that have been losing $$ in the “naughty corner” as the “Certainty Trade” reigned supreme.

Moving forward EML is trading on a lower valuation than comparative heavyweight Zip (ZIP) which we own in our Emerging Companies Portfolio but ZIP made a profit last year, albeit small compared to its $2.6bn market cap. We are positive on EML as an aggressive play with a push towards $1.40, not out of the question for this volatile stock.