Hi Andrew,

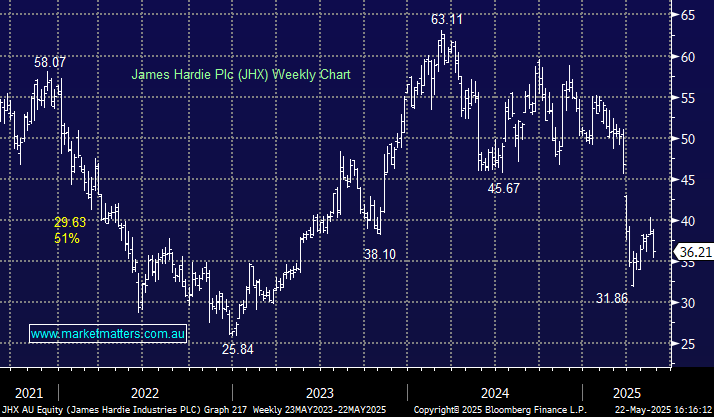

JHX is certainly a stock which irks us almost every time we look at in our Active Growth Portfolio. The board have destroyed shareholder value in the last 2-months, and frustratingly they don’t appear concerned:

- JHX announced in March that it planned to acquire AZEK (AZEK US) for $US8.75 bn in a deal described as a strategic move to expand its presence in the North American building products market. This led to the company receiving significant shareholder backlash for a number of reasons, from the substantial premium paid for AZEK to the potential shift of James Hardie’s primary listing from Australia to the U.S. We believe these sorts of things should be subject to a shareholder vote, but we also think the acquisition, in the fullness of time, will be a good one for JHX.

- This extremely unpopular takeover news was compounded on Wednesday when they delivered weaker guidance for FY26, following an inline FY25 financial result, simply not good enough for a stock standing firmly in the “naughty corner”.

We are giving JHX the benefit of the doubt for now, however, if the share price cannot hold above $35, we will likely cut it given there are more unknowns in the short term.