Hi David,

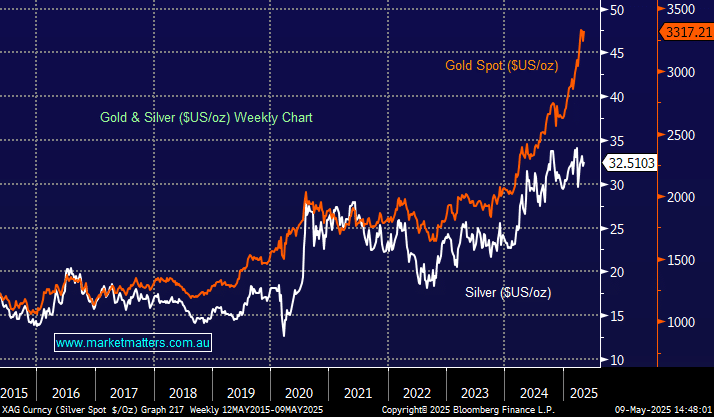

Thanks for the topical question, the reason that silver is lagging is two fold, both on the demand side of the equation:

- Central banks are buying gold as an alternative to the $US as a hedge against geopolitical risk, inflation, and currency instability – worries are brewing the $US has lost some safe haven appeal given its erratic trade policies.

- India and China are buying copious amounts of gold for jewellery; silver simply doesn’t have the same appeal anymore from than standpoint.

History shows us that gold and silver are highly correlated in price but for now silver is likely to lag until the above dynamics change. In terms of the three stocks/ETF’s our brief thoughts are:

Sun Silver (SS1) – A $96mn “speccie” that’s traded sideways in 2025, we have to be neutral.

Unico Silver (USL) – Another $96mn “speccie” that’s struggled in recent years and traded sideways in 2025, we have to be neutral.

Global X Silver ETF (SIL US) – we ae cautiously bullish this Global Silver Miners ETF, though we still have a preference for gold.

At this stage of the cycle we would rather invest and trade in the gold sector looking to adopt a “buy the dip” approach.