Hi Debbie,

Two very different yet topical questions here:

James Hardie (JHX) – Unfortunately while we believe JHX represents good value ~$37 its recent acquisition of AZEK (AZEK US) has gone down like a lead balloon and assuming the deal moves ahead it may take a few years before the stock can reclaim the $50 area. However, importantly, there is a chance the deal may still be subject to shareholder approval, and if that were to happen and it was voted down, the stock would pop very quickly.

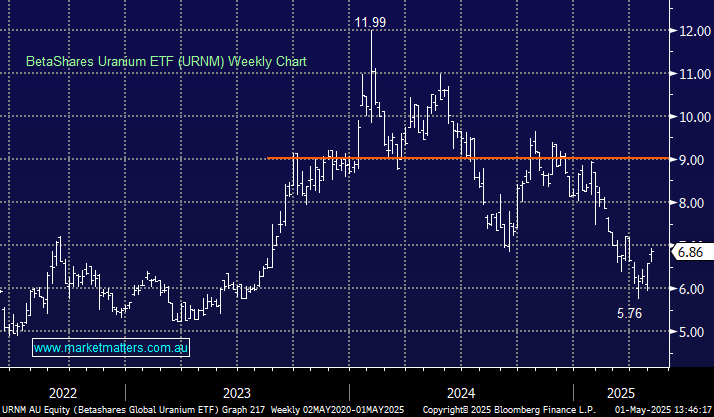

BetaShares Uranium ETF (URNM) – In line with our Thursday morning AM Report we are bullish towards the local and international uranium stocks and the ASX-traded URNM ETF is an excellent way to gain broad exposure to a basket of global uranium stocks, plus the physical commodity, with an expense ratio of 0.69% pa:

- Currently the ETF holdings include: 15.1% Cameco, 13.4% NC Kazatomprom, 13% Physical Uranium, 5.1% in Boss Energy (BOE) and 4.3% in Deep Yellow (DYL).

However, the downside is if we do get an aggressive short squeeze in the ASX sector names it will be diluted across the other ETF holdings. i.e. there will be greater returns from owning PDN or BOE directly as opposed to the URNM. It really just comes down to risk. Lower risk/return = URNM, higher risk/return = BOE/PDN.