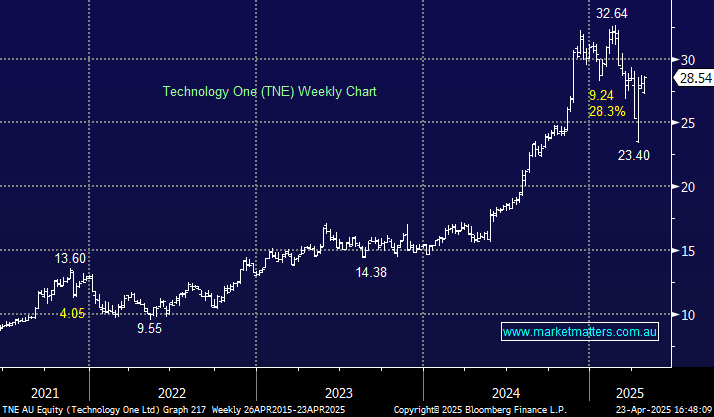

TNE rallied +3.1% on Wednesday; while it wasn’t a top performer, it’s a stock we like, which underperformed when the index fell from its February high. This enterprise software solutions company is an excellent business with recurring annual revenue of approximately $470 million, plus we believe that TNE can achieve its goal of $1 billion in annual recurring revenue by FY30. The big question is whether it’s still good value at current levels: The stock isn’t cheap, although the best rarely are, but with last year’s NPAT forecast to double from $118mn in FY24 to $239mn in FY28, it’s easy to see why investors are happy to pay the price.

- We are targeting fresh highs for TNE in the coming months, or ~20% higher.