Hi Young,

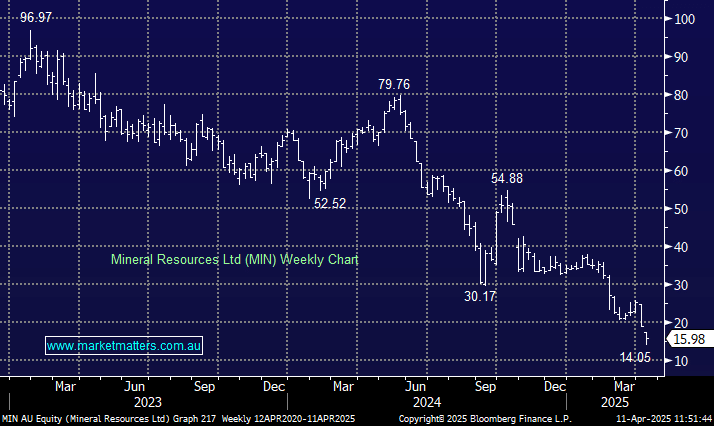

We are indeed concerned around the issues you have raised, with our position now all about damage control as opposed to making money – as we saw on Thursday, when MIN surged over +18%, any improvements of sentiment towards risk, iron ore and lithium is extremely good for MIN, at least short term.

- On Friday MIN’s 8.5% note rose 2.2% on the dollar, to 92.8c, the biggest daily increase since they were issued in 2022, not great news that they’re comfortable below 100 but at least an improvement on their all important bonds.

On the negative side of the ledger Goldman cut MIN to a sell this week with a PT of $18, due to concerns around the company’s financial health, particularly its elevated debt levels and potential liquidity challenges – nothing new here, this has been an albatross around the share price for months.

- As of December 2024, Mineral Resources reported $5 billion in net debt, with $2.5 billion in current assets against $2.1 billion in liabilities, raising investor apprehension about its balance sheet strength.

At the same time, Mineral Resources Limited (MIN) reported an interest expense of $294.7 million over the trailing twelve months hence with a EBIT of $1.1bn they have debt coverage of ~3.7x but this is narrowing. With 50% of their revenue coming from iron ore they are exposed to US-China trade hence the significant volatility over the last week – if we are correct the stock can trade back above $20 in the coming weeks/months but its going to be volatile!