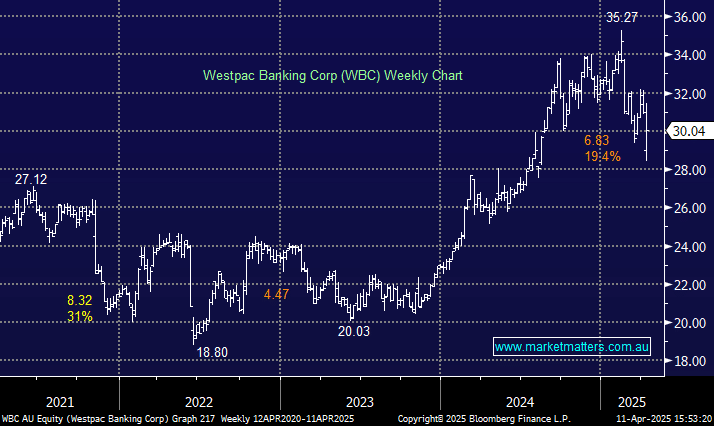

Your thoughts on a bank stock – Westpac (WBC)

Hello Esteemed Team, Times have changed. It looks like there will be hefty interest rate cuts this year. Is this likely to lower bank profits? EXCEPT for CBA, the banks have been dividend traps over the last decade and more. You have 'liked' WBC in your comments recently. It looks like you see it as a company that can provide SOME growth plus an attractive dividend. I am strongly considering buying it for this reason, but, do not wish to buy it and have it remain stagnant with no growth. I am NOT seeking personal advice. CONSIDERING the recent tariff insanity, I would like to ask you if you still have favourable thoughts about WBC? Are banks in general likely to have a bad time if there is a recession, and IF YOU were to buy WBC what price would you look at getting in and what price would you look at getting out? I realize that no one has a crystal ball. The myriad of variables created by Trump's attack on the world make it virtually impossible to make a high confidence estimate of probable outcomes. However, I am SURE your calculations would be better founded than my own. Keep up the GREAT work. Paul