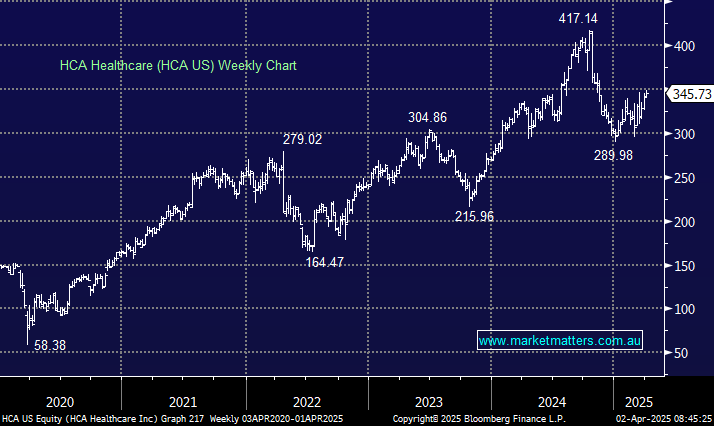

Defensive stocks have been sort after into recent weakness, and the largest for-profit hospital operator, as well as outpatient services provider in America has edged higher while the rest of the market has fallen away. However, this is a “steady eddy” compounding business benefiting from population growth along with an aging population, that trades on an undemanding valuation of 13.5x Est FY25 earnings, 10 PE points cheaper than Ramsay Healthcare (RHC)!

- Improving visitation trends has seen the stock move higher, though we still view it as an undervalued defensive position.