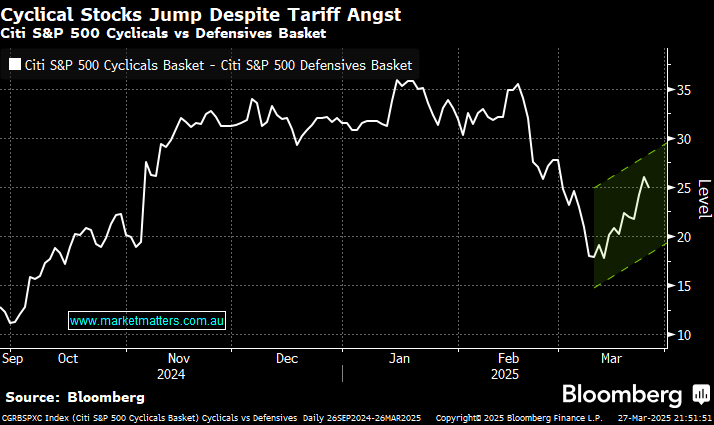

Hedge funds have begun to realign their portfolios toward economically sensitive companies that have declined over the past month, as concerns about a recession have rocked US stock markets. Last week, they bought shares of banks, energy producers, and other companies whose fortunes are closely tied to the economic cycle at the fastest pace since December, according to data from Goldman’s prime brokerage. Fund managers view sectors such as US financials and traditional US energy as largely unaffected by tariffs, making them a favourable place to hide in today’s uncertain times. A Citigroup gauge that tracks how cyclical stocks perform compared to defensive sectors, such as utilities, healthcare, and consumer staples, has recovered around half of the losses it incurred since last month’s peak – it doesn’t feel like it locally.

Compared to recent volatility, we have entered a holding pattern ahead of the pending tariff news next week. Stocks churned after the US pushed ahead with tariffs on automakers, reinforcing concern about a widening trade war and offsetting data that showed faster-than-estimated growth in the world’s largest economy – investors are trying to second guess how the new President will play his next hand with titbits to encourage the bulls and bears:

- Trump said on Wednesday that his retaliatory tariffs will be permanent for his entire second term – a tick for the bears.

- He also said Wednesday the tariffs would be “very lenient” and that he would be willing to reduce tariffs on China to help further a deal with ByteDance’s TikTok – one for the bulls.

- But on Thursday, he threatened to impose “far larger” tariffs on the European Union and Canada if they work together to combat trade his tariffs.

The almost scattershot way trade policies are being implemented has investors on edge, but if next week delivers a straightforward trade and tariff framework, it will enable companies and consumers to start making decisions again with some clarity. There is a good chance that the recent volatility and uncertainty will become a near-term speed bump, allowing markets to return to some semblance of normalcy.

- We believe the S&P 500 has found, or is approaching, a low, though a re-test of 5500 is still feeling a strong possibility.