Hi Glenn,

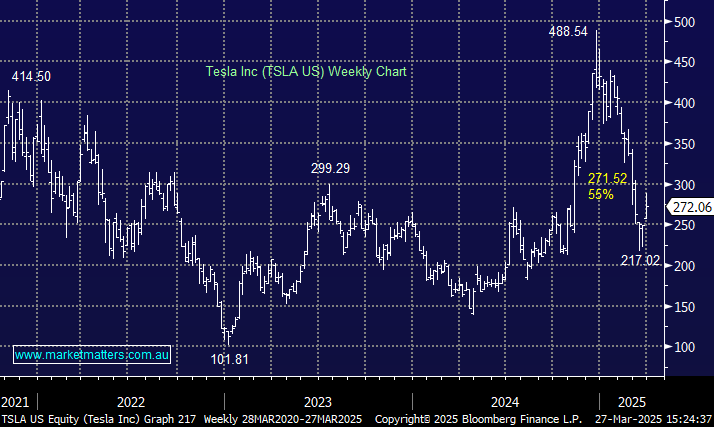

There’s two parts to this question, lets start off with EV maker Tesla Inc. (TSAL US), in late January TSLA reported earnings and revenue for the fourth quarter that missed analysts’ estimates:

- Earnings per share (EPS): 73 cents adjusted vs. 76 cents expected.

- Revenue: $US25.71 billion vs. $US27.26 billion expected.

Tesla remains a high value/growth stock trading on a huge PE, as such it doesn’t yet pay a dividend. This would be a high risk and potentially high return initial foray into overseas investing although we have all seen an increasing number of Teslas on the road over recent years: its a stock which regularly rallies 3x and halves, all in 1-2 years.

- We are neutral toward TSLA as it experiences increasing competition from the likes of BYD who are delivering cheaper alternatives while also claiming some extraordinary technical advancements around battery charging.

There used to be a way of easily buying some US shares on the ASX, via a product called TraCRs, however, they have been discontinued. However, buying US shares is reasonably simple these days with most online brokers offering the facility. Its often a touch more expensive even when brokers quote zero commission, they make their money by exchanging the currency which can often be charged at 0.7%. It’s important to sign the US tax forms which would be part of any account opening process, to avoid tax being withheld in by the US.

- MM is a big fan of international investing and our International Equities Portfolio is in the final throws of being open for investment through a simple managed account structure, with a min investment of $A100,000.