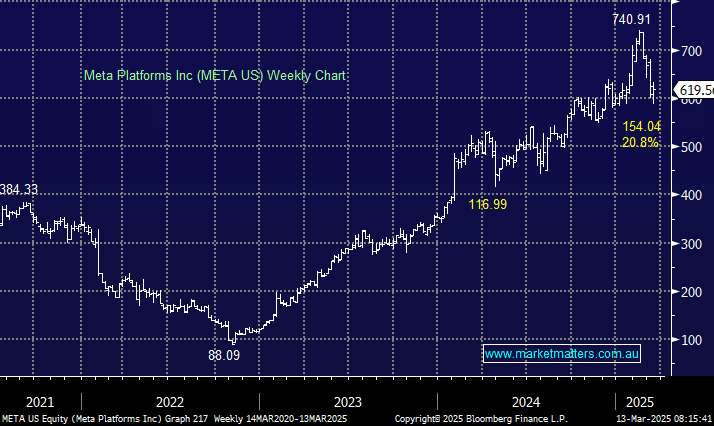

META delivered strong fourth-quarter earnings and revenue in January with sales +21% year over year, driving a +49% increase in earnings, pushing the stock to fresh highs. They are ‘killing it’ in AI and have been one of the best performers in the Mag 7. However, it has since retreated in sync with the general tech sell-off. After its result, we said, “From a technical perspective, it might be a while before we see another +$US100 pullback as we did in early 2024 to set up better risk/reward” – we spoke too soon not banking on the market losing faith in the new President.

Interestingly, reports this week from Reuters confirmed that META was testing its first in-house chip for training AI systems. This is a key milestone as they move to design more of its own custom silicon and reduce reliance on external suppliers such as Nvidia. The world’s biggest social media company is understandably looking to reduce its enormous infrastructure costs, which are forecast to be $US114-119 billion in 2025. With the late-January launch of new low-cost models from Chinese startup DeepSeek and in-house development, MM can envisage significantly reducing this overhead, which will reflect well on earnings and the share price – it won’t happen overnight, but we believe it will happen.

- We can see META testing $US750 in the coming year (s); hence, the stock looks attractive now it’s closer to $US600.