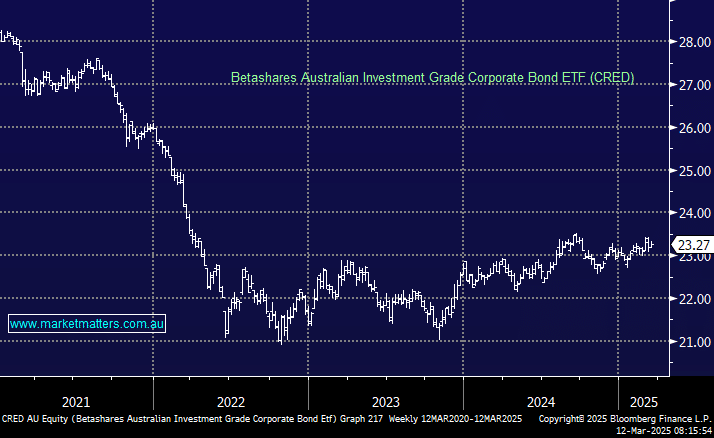

The CRED ETF provides exposure to a portfolio of senior, fixed-rate, investment-grade Australian corporate bonds. It offers investors monthly distributions while charging an annual management fee of 0.25%. We view this as a solid security for income-conscious investors, with a running yield of 5.05% and an average credit rating of BBB+ (Investment Grade).

In the Core ETF Portfolio, we are looking to diversify the fixed-income exposure to incorporate a higher proportion of investment-grade corporate bonds. This will be achieved by reducing the existing position in the iShares Core Composite Bond ETF (IAF), which holds a combination of Australian government, semi-government, and corporate bonds. This ETF provides a wider coverage of the Australian fixed-income market and yields closer to 3%.

- MM is looking to increase high-quality corporate bond exposure in the Core ETF Portfolio by adding the CRED ETF.