Insurance v. brokers stocks

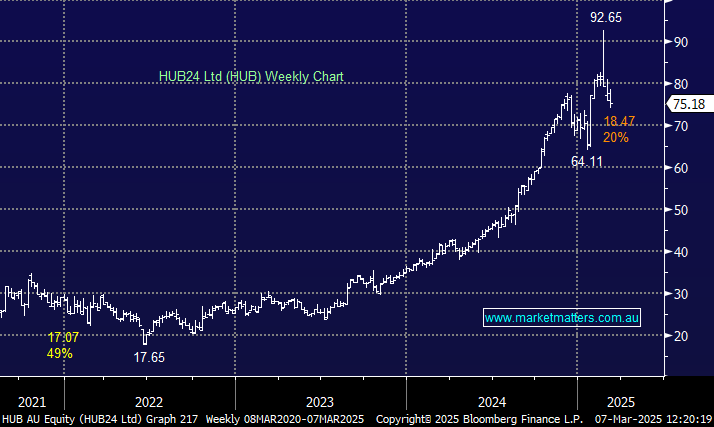

Hi James and team, Thank you very much for your calm updates and guidance in this volatile time. Much appreciated. I was interested to read your market update this morning which covered the insurance stocks and would appreciate your views on SDF and AUB as alternatives/preferences with less (claim) risks. Also, do you have stop losses for the most recent purchases of HUB and GMG? Looks like they may be going down with the tech sector. Thank you for your insights as always, Adel