Hi Richard,

A very well timed question with all three “defensive” names making fresh lows just as US investors moved down the risk curve on Friday night:

APA Group (APA): The company is due to report on Monday with last weeks drift lower probably a function of the more hawkish RBA. We have been wrong on this natural gas infrastructure business of late but we still believe its sustainable dividend in excess of 8% will have the stock in good stead over time – our initial target is $7.50.

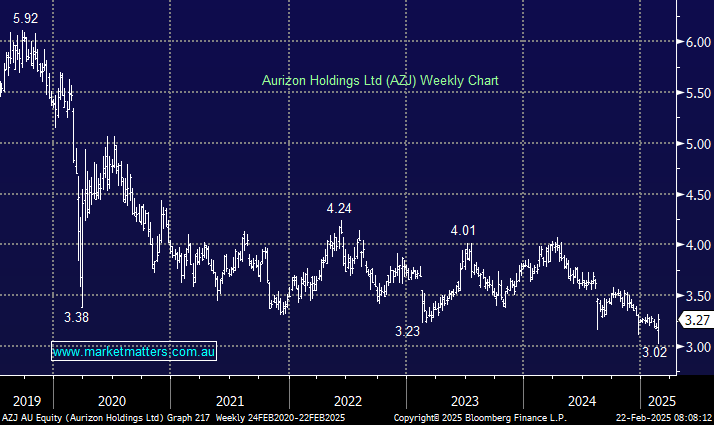

Aurizon Holdings Ltd (AZJ): Last weeks 1H25 result has not materially changed our view on AZJ. While Coal and Network provide resilient sources of cash flow, it’s difficult to build conviction around the non-coal strategies under current trading volatility. The dividend yield at 6.1% provides some downside protection especially given the room to lift the payout ratio. The stock actually closed +2.5% higher last week, bouncing over +8% from its initial spike lower after the result. We can see the stock testing above $3.50 but we don’t anticipate any fireworks on the upside.

Spark New Zealand (SPK): was smacked 19% last week after downgrading its earnings (EBITDA) forecast for the full year by ~7%. The maintained their dividend this time but if revenue/earnings keep falling in the current recessionary environment the dividend will ultimately follow. When the NZ economy starts to improve SPK is likely to turn but from where is the million dollar question. We’re not a fan of it at this stage.