Hi David,

For subscribers not familiar with IDX it is is $1.07bn leading provider of medical imaging services across Australia and New Zealand. The company offers comprehensive diagnostic imaging services, including X-rays, MRIs, CT scans, and ultrasounds, to assist healthcare professionals in patient diagnosis and treatment. They operate under various brands, such as Lake Imaging, The X-Ray Group, South Coast Radiology, Peloton Radiology, Imaging Queensland and Apex Radiology.

IDX reported annual revenue of $469.7 million for the FY24. However, it also reported a net loss of $60.7 million for the same period but after a tough few years investors have started to target IDX as a turnaround story for good reason:

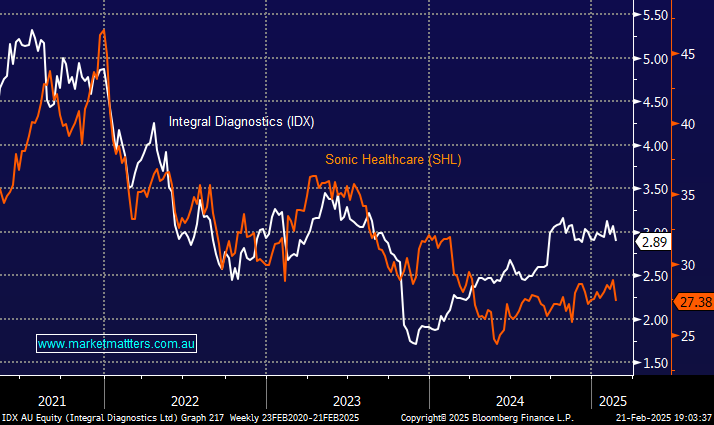

- IDX, after its recent merger with Capitol Health, is the 2nd largest radiology provider in Australia, behind SHL.

- With Medicare funded radiology volumes growing at a +4% compound annual growth rate over the past 15 years the outlook is positive as we get older.

However, while the looming scale factors should aid IDX’s efficiency/profitability the overlap between IDX & SHL is almost perfect. Hence, we would be inclined to play the sector recovery through SHL due to lower implementation risks.