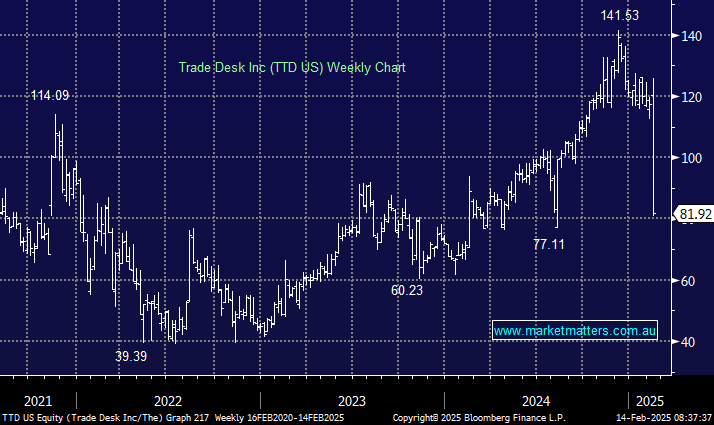

The advertising technology company delivered its first miss in 8 years overnight, coming in below expectations for the quarter and issuing lower guidance. Shares fell over 30%, chalking up its worst reaction to a result since listing in 2016 at $US1.80 per share. History shows that TTD generally beats, and the share price generally does well post results. Since they listed, they have only ever missed expectations once, and the average share price move 1-week after results is +15.95%. Markets are efficient, so we’re all holding the stock expecting a beat and bump, which didn’t arrive, hence the outsized negative reaction.

- 4Q revenue of $US741 million was up +22% yoy, but ~2.5% below consensus of $US759.8 million

- Underlying earnings (EBITDA) of $US350 million were up +23% yoy, but a ~4.3% miss to the $US365.9 million tipped.

- Total operating expenses of $US545.7 million increased +18% yoy, largely in line with expectations.

On the call last night, the CEO, Jeff Green, blamed a series of missteps and announced plans to reorganise and consider additional management hires, including a chief operating officer.

1Q guidance was also below the street’s expectations, seeing revenue above $US575 million (consensus was $US581.5 million) and adjusted Earnings (Ebitda) of around $145 million, ~24% below the $US191.6 million expected. Clearly, the share price reaction was savage, which is understandable, given this is a high-valuation growth stock trading on a big multiple, where positioning was bullish ahead of results (because they always beat & bump!).

- Most analysts maintained a positive view, though they trimmed earnings expectations. Of the 41 analysts who cover the stock, 29 buys remain, 4 sells, and 8 holds, with an average price target of $US112.10. The share price move overnight has brought it back to the levels it was trading at in August 2024.