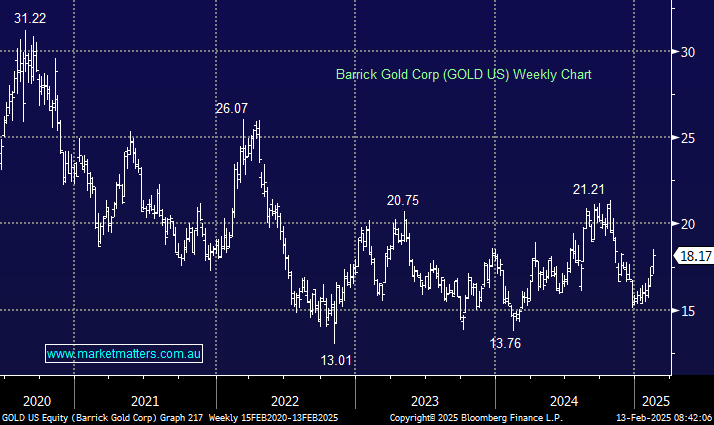

After a challenging year operationally for Barrick they’ve finally produced a strong quarter, and in doing so, they’ve achieved their FY24 guidance, which looked highly unlikely. That snaps a run of two straight years where they missed guidance which leaves a bad taste for investors (Evolution locally used to have a habit of this). Not surprisingly GOLD rallied over 6% following the result:

Quarterly financials were mixed, though better cost control led to earnings beat;

- Q4 Revenue $US3.65 billion up +19% yoy but below estimates for $US3.95 billion

- Underlying EPS US46c beat consensus of US42c

- Realized gold price per ounce was solid at $US2,657, estimated $US2,648

They released FY25 guidance that was a touch weaker than hoped.

- Sees gold production of 3.15 million to 3.50 million oz vs current consensus of 3.70 million oz

- Sees gold all-in sustaining cost per ounce $US1,460 to $US1,560

- Capital expenditure guidance of $US3.10 billion to $US3.60 billion considerably less than estimates $US4.42 billion

Overall, good to see Barrick executing and while FY25 guidance was a touch light on, they’ve addressed intended capex and authorized a new $US1bn share buyback.