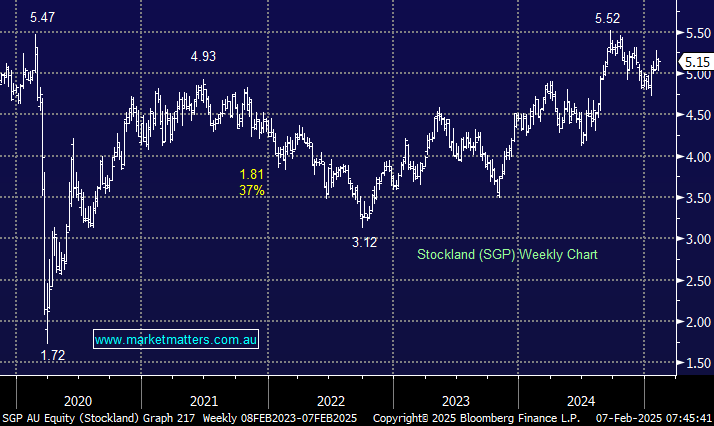

Due to many Australian fixation with property prices real estate is one of the first sectors that investors consider when interest rates fall, which makes sense as the family home often goes up in value. SGP is forecast to yield over 6% unfranked over the coming 12-months and being one of Australia’s largest diversified real estate investment groups, it should benefit from the much anticipate lower interest rate environment.

While SGP remains many investors preferred “residential recovery” play with low gearing and capital partnerships in place, the stock hasn’t gotten ahead of itself over recent months and the risk/reward looks attractive as the stocks moves above $6 – the company doesn’t report until June hence we see little downside from here assuming the RBA follows the script.,

- We can see SGP testing $6 in 2025, helped by the tailwind of lower interest rates and a strong yield.