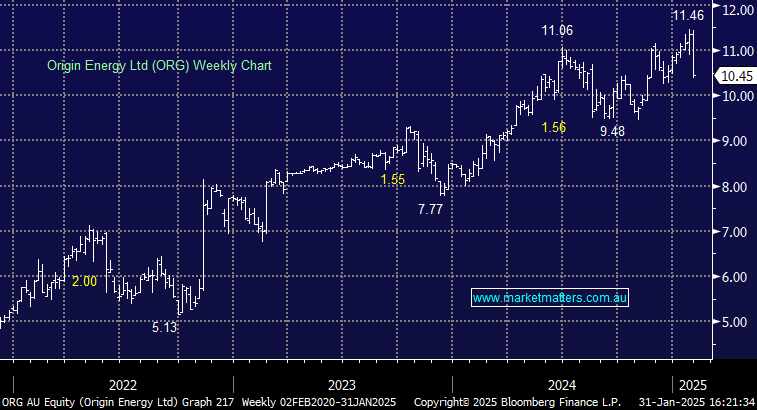

ORG –6.7%. Moved lower on a production downgrade. The headline figures were good with gas sales up driven by LNG prices, but overall result was tainted by lower short term domestic volumes.

- Australian LNG revenue up 3% qoq at $2.71bn

- FY25 LNG production guidance adjusted 2-3% lower at 670-690PJ vs. 685-710PJ

- Capex and Opex guided 3-4% lower

Unplanned maintenance and lower field performance as well as weaker well optimization were cited as reasons for the downgrade. ORG reiterated LNG trading half-year EBITDA of $285m was in line with FY25 guidance of $400-$450m however the production downgrade puts full year earnings at the lower end of guidance giving rise to the selloff today.