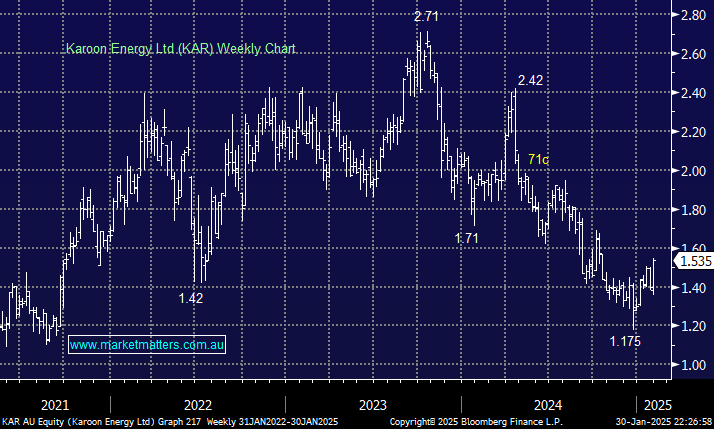

KAR was the best-performing ASX200 stock on Thursday, surging +7.7%, its largest gain since August. The energy producer released its quarterly update and announced an additional $US75mn on-market buyback through 2025. Combined with the current $US25mn buyback program, the stock should be well supported when energy prices turn higher. KAR has been a standout laggard over the last 18 months, but the board clearly now believes the shares are offering deep value.

Since late 2023, the stock has resided firmly in the “naughty corner” due to a combination of operational and production interruptions at Who Dat Field, and the subsequent negative market sentiment and analyst downgrades. This is starting to look and feel like a potential turnaround story, something analysts have been looking for / expecting for a long time, with 11 buys, 2 holds and no sells with a few targets from the bulge bracket brokers in the mid $2’s.

- We are neutral toward oil stocks over the coming months, but KAR is setting itself up as an excellent proxy for when the energy sector does turn.