Hi Shane,

This $690mn SA based company only listed in April 2024. It provides specialised trade-skilled services to the mining, resources, and industrial sectors. The company currently operates through four main divisions, electrical, mechanical, civil and water & fluids.

- The company trades on an Est P/E for FY25 of 13.9x while it yielded 2.2% ff last year, not a lot of history here for obvious reasons.

TEA has demonstrated significant growth in recent years, accompanied by a strengthening balance sheet. The company’s net profit after tax rose to A$30.5 million in 2024, compared to A$19.5 million in 2023 and A$13.6 million in 2022.

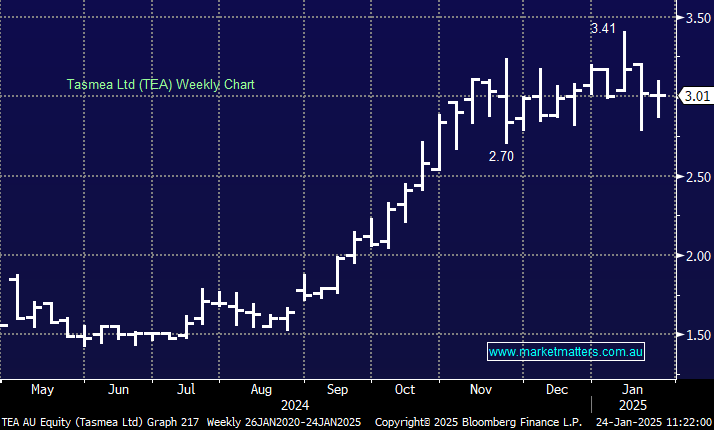

So far Tasmea has effectively managed its financial growth, while enhancing profitability and strengthening its balance sheet through strategic acquisitions and operational efficiencies. As is common, its probably picked the low hanging fruit first but we like what they’ve done so far, and the stock looks good value under $3.