Hi Debra,

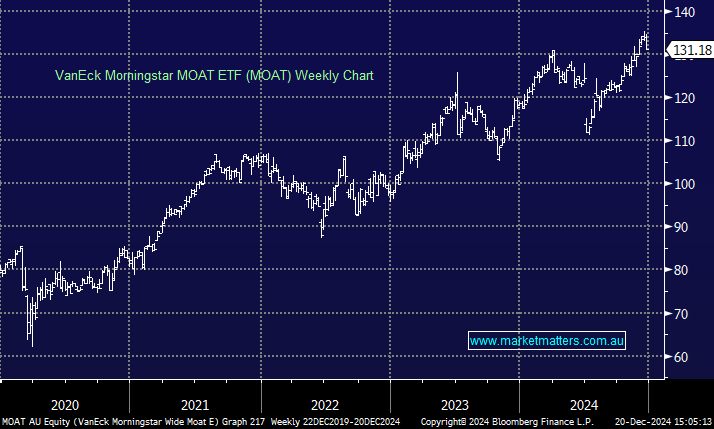

Firstly, the VanEck Morningstar Wide Moat ETF (MOAT) is an ETF that seeks to track the performance of the Morningstar Wide Moat Focus Index. This index is designed to invest in companies with sustainable competitive advantages (a “wide economic moat”) that are trading at attractive valuations relative to their intrinsic value.

- Its top 5 holdings are Microsoft (MSFT), Alphabet (GOOGL), Berkshire Hathaway (BRK.B) and Meta Platforms (META) – we hold the first two in our International Equities Portfolio.

- Historically, MOAT has delivered competitive returns compared to broad U.S. equity indices and with a market cap of $US18.2bn liquidity isn’t an issue, plus with a mgt. fee of 0.49% is not onerous.

Secondly, Healius (HLS) has announced plans to distribute the majority of the proceeds from the sale of its Lumus Imaging business to shareholders via a special dividend. The exact amount and timing of this distribution are yet to finalised but the sale is expected to be completed in the first quarter of 2025. They also have ~$1610million in franking credits which would be used to enhance the value of the dividend for local shareholders.

- At this stage we are holding HLS but we are open-minded into the current sell-off depending if other better opportunities come along, hence the comment about a potential funding vehicle given HLS has a low correlation to the market.