The fanfare around DigiCo’s (DGT) recent $2bn data centre IPO has quickly faded. In its second session on the ASX, the REIT fell another 5.5% to $4.30, over 15% below its $5 offer price. This is not bullish price action, and it will be interesting to see which broker is doing the selling given pretty much all shops on the street were involved in this big deal – particularly the retail brokers.

While most of the stock went to retail investors (NB: we did not participate), Cooper Investors is the first substantial shareholder notice lodged yesterday, showing a 5.35% holding bought for $5 in the IPO i.e. $145m position that is now worth ~$125m.

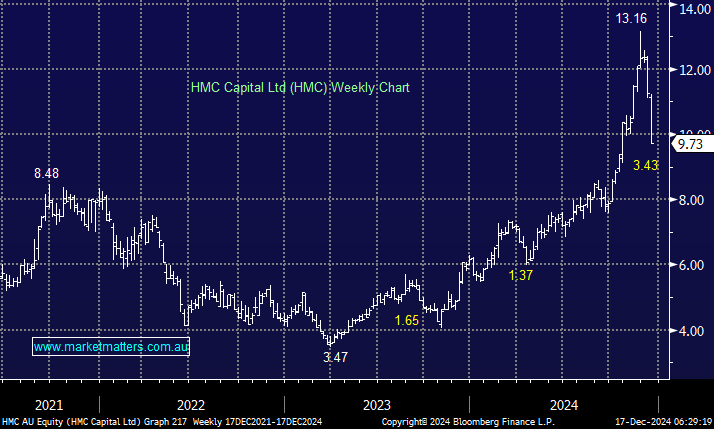

We started to monitor the price action of DGT yesterday and it looks interesting. We imagine some institutions will now be reconsidering this into weakness. Not surprisingly, major DigiCo investor HMC Capital sank 13.7% on Monday to $9.73, a whopping 26% below where it was trading into the IPO.

- We can see value returning to HMC under $10 & DGT ~$4.30