Hi Glenn,

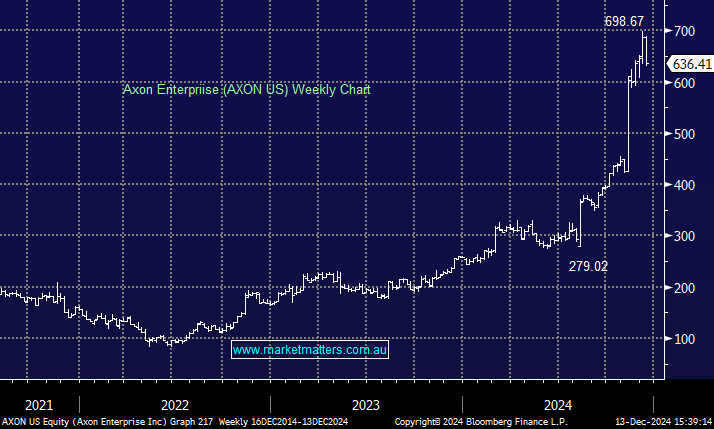

Axon Enterprise (AXON US) is a$US48bn public safety technology company which is best known for developing TASER energy weapons, widely used by law enforcement and military agencies as non-lethal tools for conflict de-escalation. Over the years, Axon has expanded its offerings to include cloud-based digital evidence management platforms, body-worn cameras, and other software solutions to support law enforcement operations.

- Last month, AXON reported its Q3 2024 earnings, which highlighted significant year-over-year growth in revenue, earnings, and recurring revenue, exceeding analyst expectations.

- They achieved revenue of $544 million, a 32% YoY increase, surpassing analysts’ estimates of $478 million. Its EPS came in at $0.86, with a net income of $67 million. The company also reported a gross margin of 60.8% and an increase in annual recurring revenue to $885 million, up 36% YoY.

We like AXON and can definitely see it considered by MM in 2025.

Micron Tech (MU) is a $US109bn leading producer of semiconductor memory solutions. The company designs, manufactures, and sells a wide range of memory and storage products, its best known for DRAM (Dynamic Random Access Memory), NAND Flash Memory and 3D XPoint Technology.

- For FY24, Micron posted revenue of $25.11 billion, and EPS of 79c with strong growth driven by robust demand for AI-driven solutions and data center products.

MU shares have been facing headwinds recently with concerns over global economic conditions and the impact of U.S.-China tensions on semiconductor exports. Additionally, Micron’s profitability has been affected by fluctuations in memory pricing and increased competition in the semiconductor space.

We are neutral on MU around $US100.