TTD is an advertising technology company that offers an online platform enabling advertisers to bid on and purchase digital ad inventory in real-time auctions – very much like a Bloomberg Terminal but for ads instead of stocks. It covers multiple advertising channels, including display, video, mobile, audio, connected TV (CTV), and native ads, using advanced data analytics and machine learning to provide insights into campaign performance. Importantly, it enables precise audience targeting based on demographics, behaviours, and other data points, essentially changing the way advertisers get in front of their target market.

Importantly, advertisers can manage campaigns across various channels and devices from a single interface and monitor their performance in real time. It’s just a phenomenal platform and is gaining huge traction, particularly in Connected TV (CTV) which remains the company’s fastest-growing channel, fuelled by deep partnerships with major players like Disney, Netflix, Walmart, and Roku.

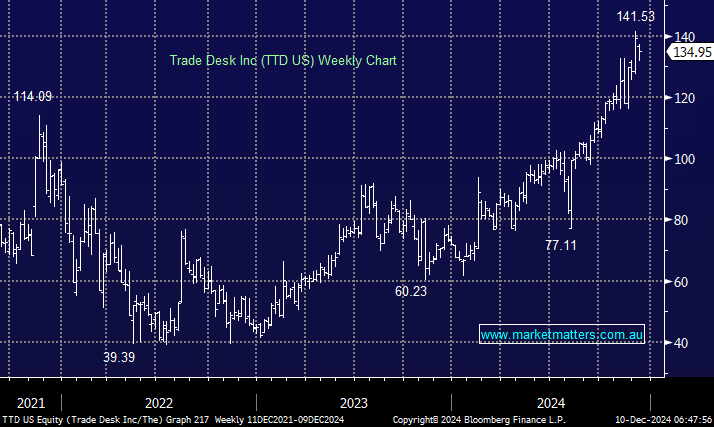

We are showing a paper profit of more than +200% on our position, and while there were some signs of a mild slowdown in growth at their last quarterly, any weakness associated with that in our view, provides an opportunity for investors. If we look forward, we expect TTD to consistently grow their top line (revenue) at more than 20% per annum for the next three years and with greater scale and operational leverage kicking in, earnings should compound at 25-30% annually i.e. profit to double by 2027.

While the shares are not cheap, the flywheel is clearly working, and TTD is a leader in a significant market with a huge runway of growth ahead.

- We are long TTD in our International Equity Portfolio, looking for medium-term ongoing strength—a stock to “Buy the Dips” in.