Hi Helen & Angela,

Welcome to MM Helen, we’re really glad you are enjoying the service!

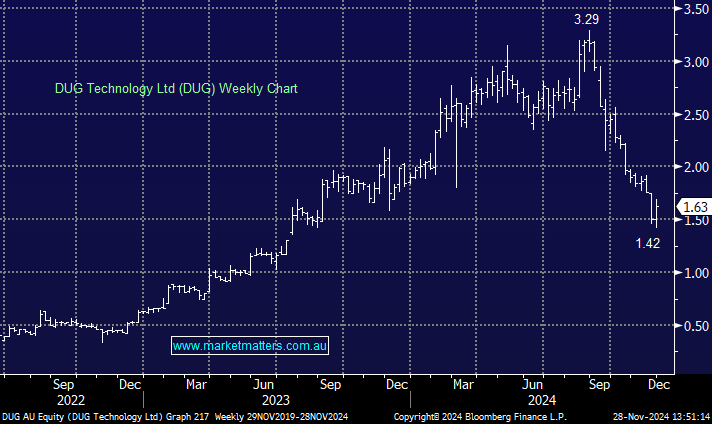

DUG is a new company to the MM Report, and we get 2 questions in one week!. DUG is a $220mn business that raised capital to capitalise on growth opportunities in high-performance computing and geoscientific technologies.

- Unfortunately we are not surprised the company doesn’t talk with individual investors on a day to day basis BUT they should not promise to call back and fail to do so.

There recent capital raise was successful, raising ~$30.2 million through a two-tranche placement to institutional, sophisticated, and professional investors. Additionally, a Share Purchase Plan (SPP) raised AUD 1.23 million from existing eligible shareholders. These funds are said to support DUG’s growth initiatives, including expanding its Houston data center, establishing a new office in Abu Dhabi, and advancing its DUG Nomad modular computing solutions.

Its not uncommon for a stock to fall below is SPP but in this case the magnitude of the raise compared to the companies market cap. was the first thing to catch our attention. DUG’s cash burn rate has been the notable challenge. In the last 12-months, the company reported a negative free cash flow in excess of 28 million. This reflects operating cash flows of 18.15 million, offset by substantial capital expenditures of 46.77 million, which were invested to support increased compute capacity and infrastructure growth.

- With the fresh cash injection its time for DUG to deliver, we would be watching the cashflow and operational improvements carefully in the coming updates now the business is relatively cash rich.