Hi Mark,

You are correct, there are no franking credits on international shares. Australia does have a tax treaty with the US, whereby, Australian investors sign a W-8BEN form to reduce the tax US authorities withhold. The form needs to be signed every three years. If the form is signed, there is 0% tax on sale proceeds while dividend payments are taxed at 15%. If no form is signed, the Internal Revenue Service (IRS) will charge 30% tax on sale proceeds and a 30% tax on dividend income.

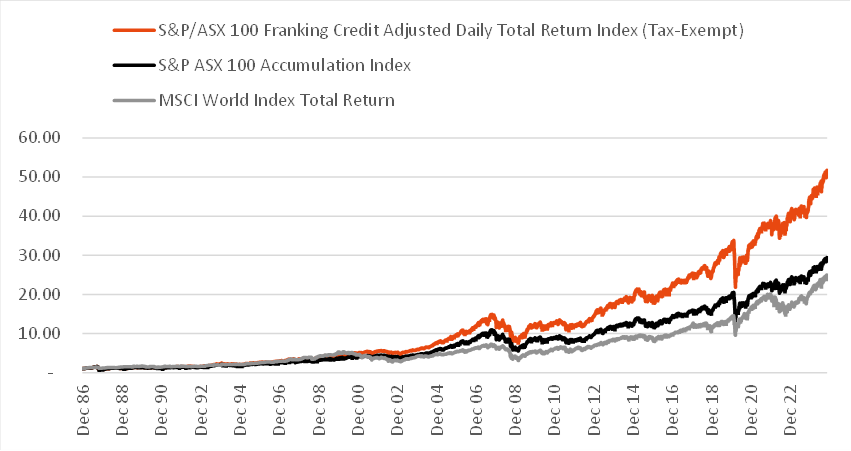

Franking credits are a very overlooked factor in the Australian investment landscape. For some context here, we measure investment returns including franking credits. They make a big difference to returns. 10.95% CAGR for Australian shares including franking, 9.31% without and 8.82% for the MSCI World Index