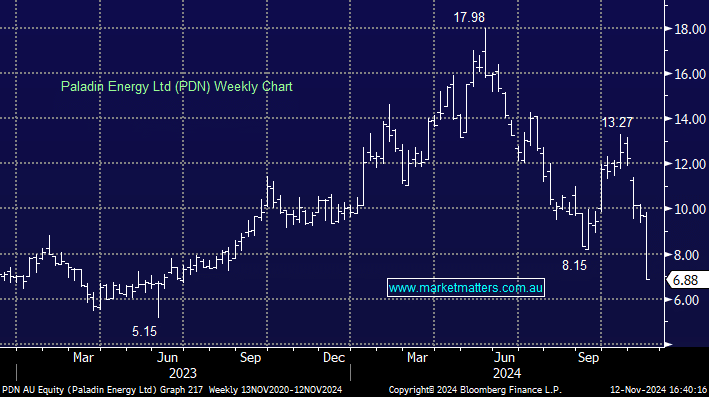

PDN -28%: The Uranium miner got hit today on the back of some production issues relating to lower than expected grade from existing stockpiles and a lack of water. The call with management today had the following key takeaways, though the market clearly did not agree by the close;

- The market has wiped $800m off the market cap of PDN, which seems a big overreaction.

- They have lost ~1mlb of uranium resource (from low grade in the stockpiles) which at a margin of US$40/lb is only about A$60m in value

- The grade issue in the stockpile is due to poor mining practice historically – apparently waste has been dumped with the ore. This has no implications for future mining operations or grade variability. It means production during the ramp-up will be about 1Mlb lower than expected.

- The water issue is a NamWater delivery issue – NamWater will be upgrading its facilities in November. Paladin has 8-9 days of water storage on site that it has not been able to fill – they will do that during the upcoming shutdown. That will provide a buffer going forwards.

- Clearly there are some concerns from a markets point of view about the balance sheet. This was questioned specifically on the call

- The balance sheet is fine – there is enough liquidity, and Paladin is now cash flow positive. They have US$55m in cash, and US$55m in available debt funding.

- The plant is running well – recoveries now up to 87%

- There is no issue with the contract book – they have enough production to meet all customer commitments.

While we are at maximum weighting in two portfolio’s (~4%), we view this sell-off as very excessive for what has been announced.