Hi Scott,

We will never tell anyone why they should do one thing or another – that is outside our remit. We write about what we are doing and it is in subscribers court to decide what they do with that general information.

That aside, a great question and we hear/share your frustration at times. However, as we quote almost daily “past performance is no guarantee of future performance”. At the moment the US has a new very pro-business President and we have a government which is increasing hurdles to small and large business on a regular basis but it can be dangerous making assumptions about future performance by looking backwards, or indeed fretting about the current landscape.

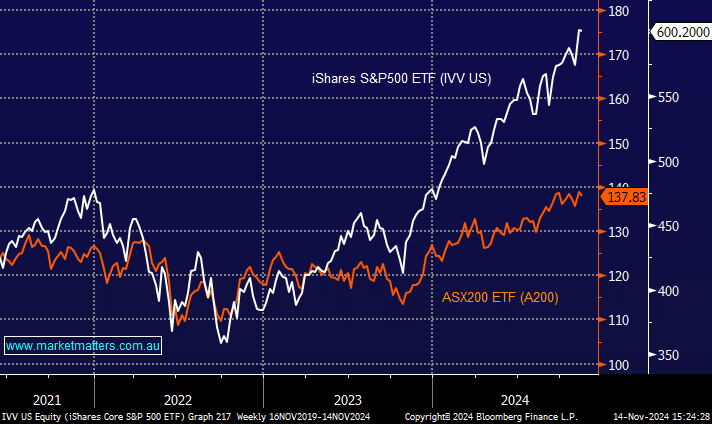

- Its not just the miners which are cyclical in nature, so are economics and relative countries stock market performance – what’s worked for the last 2-years might not for the next 2-years.

That said, we are big believers in investing overseas, and we know the funds following our International Equities Strategy have consistently grown since launching it 5-years ago. It is our best performing portfolio, up 17.84% per annum since inception in 2019, 4.5% ahead of the market per annum.

Looking at expected (consensus) growth rates for Australian and international markets does indeed paint a better picture overseas;

- Australian ASX 100: 18.9x trailing earnings for a 2 year forward growth rate of 4.2%.

- Compares to the US top 100. 26.8 times trailing EPS for a 14.1% two year forward growth rate

- Or better still the world-ex the US. 15.9x for 11.8% compound growth.

- For the brave, what about China? 20.7x for 18.1% growth.

Putting all our eggs in one basket is not how we go about investing. It may work for some, but we are more measured in our approach and do not chase the best performing market historically with all lour capital.