Hi Phillip,

AGL was hit on a downgrade from Barrenjoey to underweight from neutral. The move was big because the note from Dale Koenders was original and delved into information that has not been covered by others. Essentially, he flags an earnings headwind from FY27 as two supply contracts roll off, specifically, the QGC gas supply contract expiring in December 2027 & Wilpinjong coal supply contract which expires in December 2028.

- The analyst believes that it will result in an aggregate $300 million reduction in group earnings (EDITDA) from FY27-FY30, based on a review of public information regarding its gas and coal supply contracts.

On that basis, they reduced their earnings (EPS) forecasts for FY26-FY27 by 8-13%, and FY28+ by around 30%, reducing PT to $11.20.

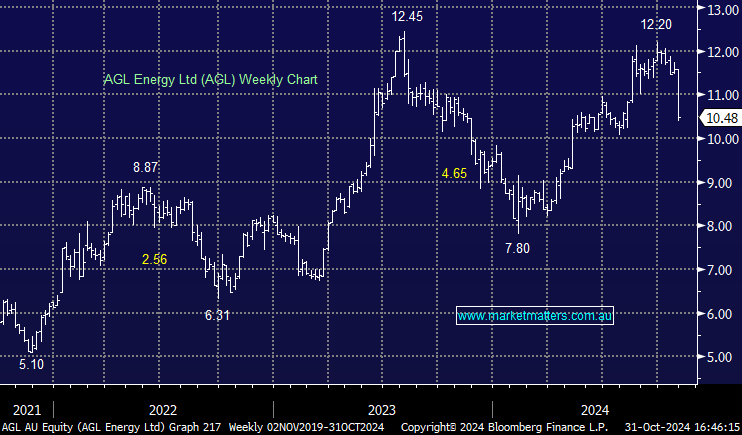

That said, the decline has now priced in that risk in our view, and the risk/reward looks solid ~$10.

RE BCB: The book message from yesterday read…The minimum subscriptions requirement under the Bowen Coking Coal Ltd Entitlement Offer has been met, with firm bids and sub-underwriting commitments in excess of the targeted offer size of $70 million.