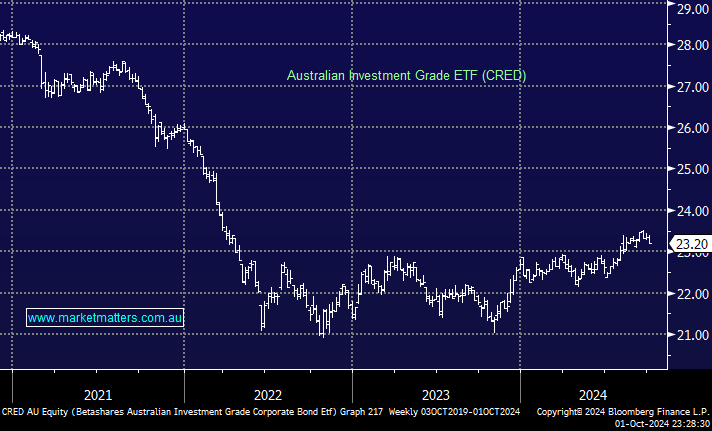

As expectations around interest rates have changed, fixed-rate bonds have increased in value underpinning strong returns for this asset class over the past 12-months. CRED, which primarily invests in fixed-rate corporate bonds with a focus on high-quality, investment-grade bonds issued by Australian and international companies, has benefitted from this move, booking a 1-year return to 30 August of 10.06% – which is a great year for this type of investment, though longer term performance has still been a struggle, with 3-year returns of -1.26% and 5-year returns of 0.61%. The running yield is also lower than HBRD at 4.76%, meaning, that to get higher returns, we need to see bond prices higher which is a function of the market’s view on interest rates and the perception of risk.

We have written several times recently about the quantum of interest rate cuts already priced into the market, with nearly 200bps of cuts factored into the US over the next year and 100bps locally. We think this could be ‘as good as it gets’ unless we see a sharper economic contraction – a view shares by the founder & CEO of Blackrock Larry Fink overnight. While the idea of holding bonds is all about insulating portfolios from the volatility of equities, we’re more cautious now on fixed-rate bonds than we have been.

- CRED is a solid security with a sensible cost structure (0.25% and no performance fee), though, we would only be buyers into weakness, and that would take a change in the market’s positioning on interest rates, pricing in fewer cuts.