Hi Sidney,

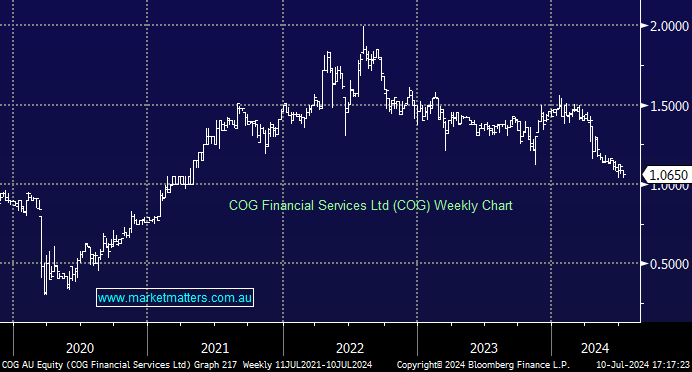

COG is a $186mn financial services business which on the surface looks cheap trading on ~8x while yielding around 9% but the stocks halved since its 2022 high more than offsetting its dividend payouts. Insiders have indeed been buying the stock well above Fridays 92c close with tranches going through between $1 and $1.40.

- While we are not close to this small cap, they invest in financing and leasing companies which is a tricky area.

- Directors buying is a good sign, we also not some new fuds on the register, namely Thorney.

- Technically its hard with no obvious support below $1, we would call it neutral at best.

Vysarn (VYS) is a very interesting business, operating in water treatment and management in mining. They just made a good Acquistion, funded by a $38m capital raise that was well bid through Unified Capital Partners (UCP), a team I used to work with who are good in this space. For those with a good memory, you might recall an analyst Jono Higgins, who was a huge bull on Zip years ago, and we did a video or two with him on this. He now covers VYS, with a 49c price target, though that would not take into consideration the recent purchase or raise – we suspect an upgrade to this target will come after the raise is all complete. A small cap, with all the usual risks, however, CEO James Clement is executing well, and we like the story, with water management a growth area. SRG Global (SRG) that we own, also operates in this area.