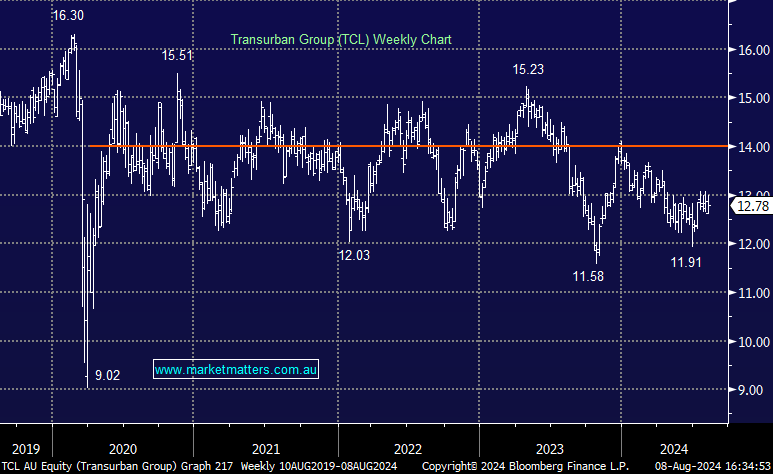

TCL -0.78%: A mildly soft result that showed conditions remain challenging

- Key for TCL was guidance around distributions, and they expect 65cps for FY25, putting it on an unfranked yield of 5%

- 2H24 distribution was 32c, equating to 62cps for FY24

- FY24 EBITDA of $2.63bn was up +7.5% on last year, but ~1% below consensus

- Net profit of $376m was solid

Solid, yet uninspiring result from TCL, with traffic volumes on the softer side and growth in Westconnex still proving difficult.