A mixed quarterly overnight for FCX, with 2Q24 production and earnings ahead of expectations, though this was tempered by an increase to cost guidance for the FY.

- Earnings per share (EPS) for the period of 46c beat expectations of 36c

- Copper unit net cash costs per pound of $1.73 were up 18% for the year but below estimates of $1.76

They said costs remain an issue, and this prompted an increase to their guidance for the full year, up to $1.63/lb versus prior guidance of $1.57/lb, a trend the market was partially expecting (consensus $1.60/lb), but not to the extent they announced.

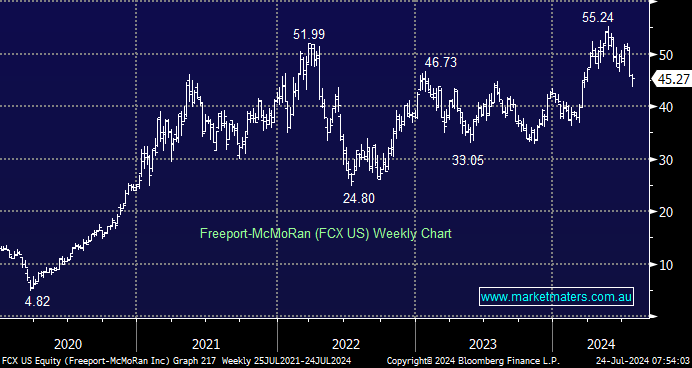

It was another solid quarter of production for FCX, and while shares were down 4.5% early, they recovered to close down 1.6%. Weakness in the copper price has seen shares pull back from record highs of $55, and we think this pullback represents an opportunity to buy the world’s largest copper producer, operating a diversified mix of low-cost mines.