Hi Glenn,

We remain bullish precious metals and especially gold. We talked about the sector in Thursdays Morning Report, believing that looming rate cuts, especially by the Fed, will be the main driver of precious metals over the coming 6-12 months. Geo-political issues have exerted very little influence on the sector outside of a the occasional 24-48 hour spike. A quick summary of our view is:

- We are bullish gold medium term targeting the $US2,550 ($A4,000) area but short-term its a touch 50-50.

- Gold stocks look poised to outperform after struggling over recent years.

- Gold is a cyclical commodity hence we won’t be afraid to sell into new highs but we are likely to be fussy.

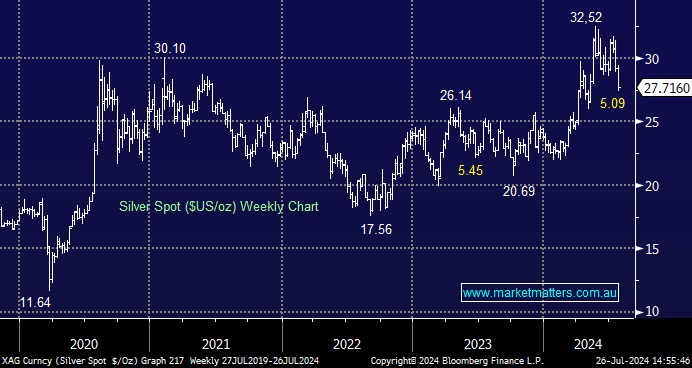

NB we added the silver chart as we’ve previously focused on gold, ultimately, we see silver rallying towards $US35/oz and like the risk/reward below $US28.