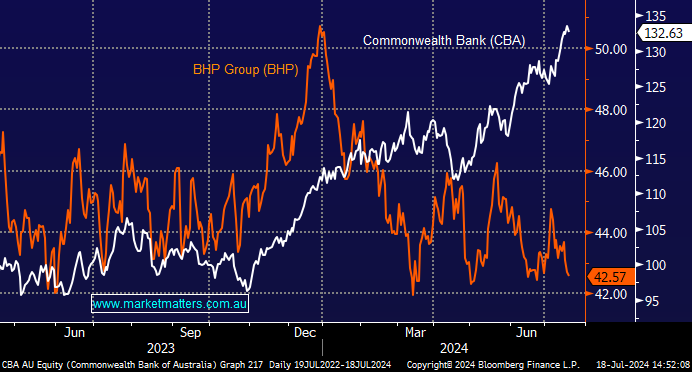

Is it time for Big4 to Resources Switch?

Hi James and Team. Not a very original question I'm afraid, but pertinent to many at this point I think. Given the commentary by many that the big banks look over-valued through the lens of bothP/E and Book Value, and with ANZ a shade under $30 and BHP down to $42.70 this Wednesday evening, is it time to consider Bank to Resources switches? I am particularly interested in your thoughts on ANZ, WBC, BHP, FMG and PLS. You guys have been very 'on point' of late - thank you for your great service.