Thought on IPG and TLX

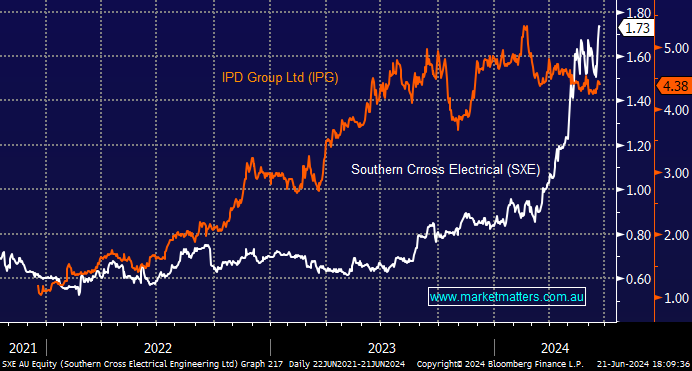

Keen for your thoughts on IPG and COH. a) IPG - SXE has run incredibly hard and IPG to a lesser extent of late. It seems IPG could also be a beneficiary providing many products that SXE may require to deliver their services. IPG also leverage to the electrification of everything. Recently entered sub $4.20 for a medium term hold. b) Keen for your recent thoughts on TLX? Currently hold RMD and CSL and looking for another healthcare stock. TLX seems to be better placed compared to RHC and SHL which continue to experience ongoing cost issues. TLX also appears to have more catalysts in the short term that RHC and SHL