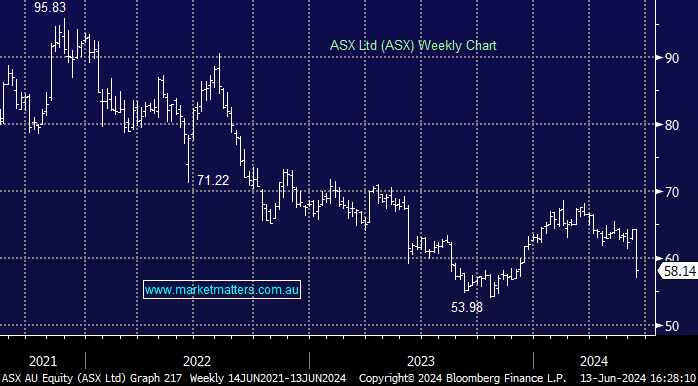

ASX -8.01%: the operator of the Australian exchange fell to 6-month lows today after cost and capex guidance missed expectations. The company expects costs to grow 15% in FY24, right at the top end of guidance, while capex is expected to be $135m for the year, above the midpoint of guidance at $110-140m. They also expect cost growth of 6-9% in FY25, largely in line with expectations though coming from a higher base and capex guidance for FY25 is 30% above consensus at the midpoint. With the increased investment and costs, ASX has walked back its FY25 ROE target of 13-14.5%, now seeing that “over the medium term.”

- Overall, the costs and investments will leave less in the till for shareholders, while the company has a poor track record of investment returns.