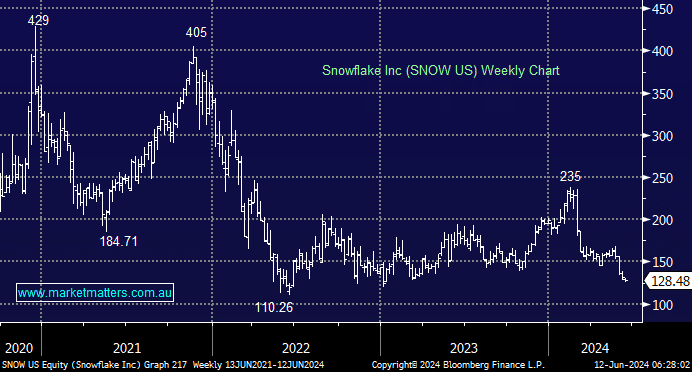

We’ve written very positively about US-listed data business Snowflake (SNOW US) on many occasions (a history of this can be viewed on the site here), but more recently, the share price has come under pressure, and we’re now sitting with a 14% loss on our 5% holding, having been up significantly at various times since originally buying in 2022. It seems some investors have run the three-strikes policy, and simply cut the stock, pushing shares down ~50% from this year’s high.

- The first negative was the surprise departure of their CEO Frank Slootman in March. While Google’s ex-top advertising exec Sridhar Ramaswamy has taken the reins, such a significant change can unsettle holders.

- Snowflake held its annual investor day early in the month and focussed more than usual on new product launches designed to drive future growth. The problem with this message is it implies that SNOW is currently sowing, rather than reaping, and for a stock trading on such a lofty multiple (10x revenue), the growth over FY25 may underwhelm, even if outer years will be better.

- The competitive backdrop is now much tougher, with more pressure from Microsoft, AWS and Databricks. These rivals are investing aggressively and/or acquiring to AI-enable their suites.

While we believe Snow remains a very strong business, still growing the top line at over 30% driven by increasing demand for data underpinning AI, the challenge for the stock is that the pay-off period on new product launches could be a year or two away. Margins in that time will therefore likely underwhelm, the impact of which is amplified by persistently high interest rates.

- In short, there are a lot of variables at play currently; SNOW is not a clean growth story in the near future, which prompts the question, why wait?