Hi Paul,

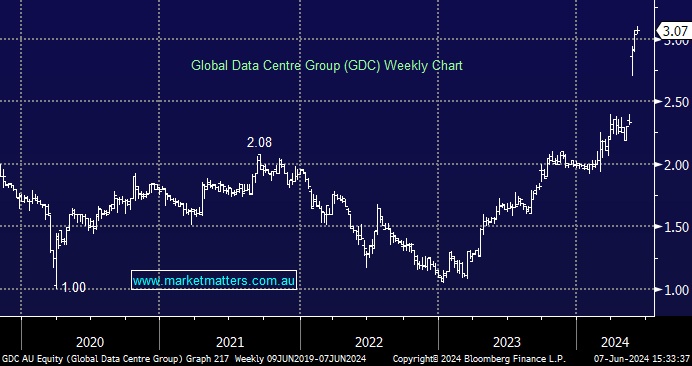

Global Data Centre Group (GDC) – GDC, was formerly 360 Capital Digital Infrastructure Fund held data centres, clearly a hot space, and they’ve done a good job of realising value that the market wasn’t offering by selling the underlying assets for a premium to the market price at the time. Their main asset was its co-controlled investment in European data platform Etix Everywhere which they are selling to French asset management company Infranity Equity Fund for around $175mn, which is worth $2.26 per share. In April, they also announced the sale of Perth Data Centre to an undisclosed buyer for $39m.

Based on the current market price, and considering they still have some debt, we think it’s now trading at fair value – i.e. the re-rate has now been fully realised. This was clearly a good strategy, if some of the property companies and even the LIC’s could sell-assets above the prices being applied by the market, a similar sort of SP reaction would play out.

Omni Bridgeway (OBL) – is not one we know that well, however they look to be still losing money and they’re balance sheet is questionable.