Hi Nick,

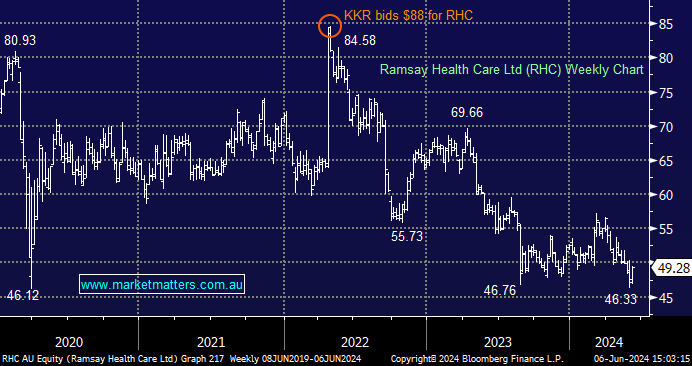

A very fair question and while RHC is not our proudest moment the answer is straightforward;

- If we held no position in either we would be looking to buy RHC at current levels, but not CTD

- CTD has an external risk leading into the UK election that we were uncomfortable with, so we cut the position to reduce risk.

- While RHC has been under pressure, we find it easier to value the sum of the parts, being property and then the operating businesses – which gives us more comfort relative to CTD.

- On review, we focussed too heavily on this valuation as a driver for holding. There are many other factors at play, with valuation only one piece of the puzzle.

We believe RHC is “cheap” under $50 and we are happy to remain patient for now. If our position was smaller (currently 5%), we would be averaging.