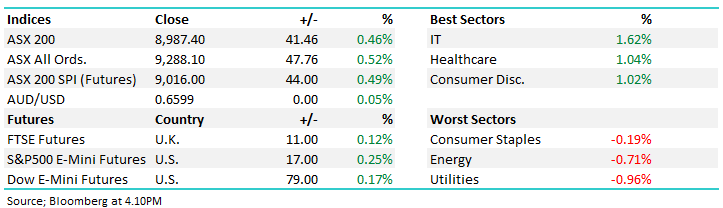

Of the two major names, COL’s has outperformed, however it was coming from a lower base and has more room for improvement, although its share price is unchanged for 2024 – hardly exciting. Their 3Q trading update in late April was better than WOW, although it still only received a mixed reception. Coles trades on a PE of 19.2x which is 11% ‘cheap’ compared to its 5-year average while yielding 4.2% fully franked. The bullish argument here is that Coles is undervalued, trading more than 1 standard deviation below the norm, however, identifying a catalyst for a re-rate in its earnings multiple, and thus the share price is a tough ask.

Goldman’s raised their call on COL in the middle of the month back up to a neutral rating with a $16.30 price target, which is a bit how we feel, very ho-hum. Population growth is a clear tailwind for retailers of staples – things we need every day – however the expanding population has become a political football into next year’s election, which could weigh on the projected outlook for both COL and WOW.

- We would consider COL below $15, it’s not just not that exciting around $16 without an easily identifiable catalyst.