At MM, we adopt a “top-down” meets “bottom-up approach” to investing. In other words, we identify the macro-picture and sectors which should outperform accordingly before boring down into the individual stocks which should benefit the most and pass MMs screening. Importantly, within individual sectors there are many different companies exposed to different drivers, and this is certainly the case in Energy sector where the likes of Thermal Coal, Oil, Gas and Uranium, can all be pulling in different directions at once.

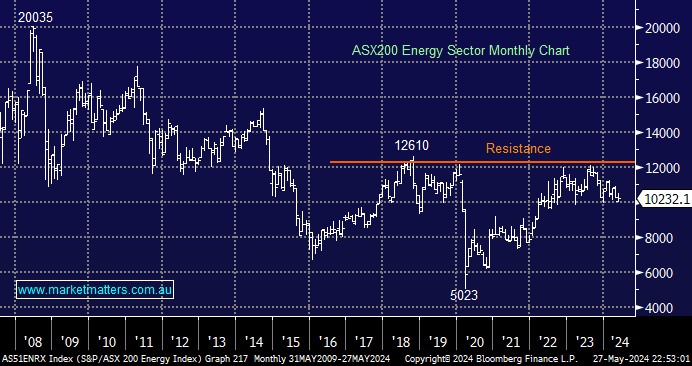

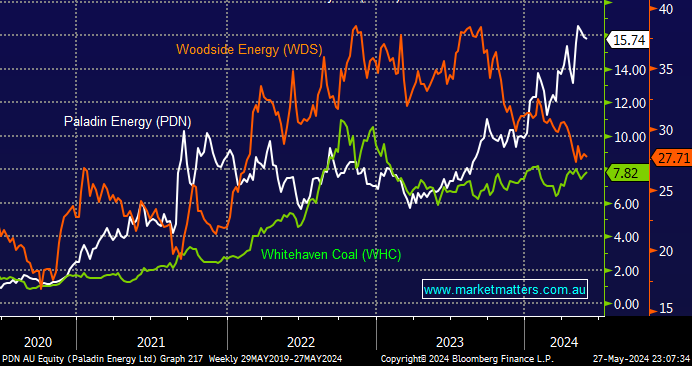

So far in 2024, the Energy Sector is down -3.7% in a year when the market has risen +2.5%. However, under the hood, we’ve witnessed Paladin (PDN) surge +60%, and Strike Energy (STX) plunge 57%, i.e., not all boats rise as one

- In a sector like Energy, we are less interested in how the sector trades and far more focused on a more granular level.

A quick glance at three stocks in differing areas of the Energy Sector illustrates they run their own race, e.g. over the last 12-months, Woodside (WDS) has fallen while Paladin (PDN) has boomed.

Hence, this morning, we’ve updated our views on three stocks in the sector which either are, or have been, in MM portfolios in recent years.