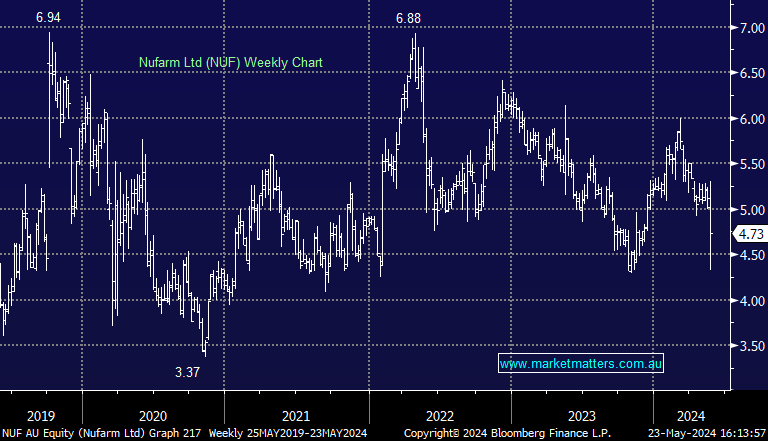

NUF -7.07%: The volatility continued today for Ag related stocks with Nufarm materially missing expectations at their 1H24 results, while their FY24 earnings guidance was also weak. The stock was hit hard early , down 13.5% at its worst testing its 12-month low in the process, before recouping half of the losses. Once the conference call started though, things improved amid some confidence that this may be the low point emerged. While we missed the call, the main takeaway according to Citi was that Australia and North America have seen channels work through a large part of inventories implying a transition to restocking could be on the cards.

NUF have now guided to FY24 EBTIDA to be between $350-390mn vs consensus $436mn, implying a 15% downgrade at the midpoint. They did say FY26 targets remain in play, however it’s hard to see how they’ll be achieved. Leverage is also high given the lower earnings base and a reduction here will be a key focus. On the positive side, seed technologies and volume uplift in crop protection was good, but not enough to offset the weakness elsewhere.

- Overall, a tough half but things will get better, pretty much a standard script from Ag-related companies of late.