Apple’s quarterly revenue declined as it faced declining iPhone sales and anaemic demand for its products in China, but the Bloomberg headline summed up the market reception of its earnings numbers nicely, “Apple sales drop less than feared as company plots comeback”. Some of the headlines in the company’s earnings were very impressive:

- Apple’s services business delivered $23.9 billion in revenue for the March quarter, up 12.4% from a year earlier – the consensus was $23.1bn.

- Apple increased its dividend by 4% and announced plans to buy back up to $110bn in stock—more than the market cap of CSL or NAB + it would be the biggest buy-back in American Corporate history!

- Apple’s net income was $23.6 billion, or $1.53 a share, compared with $24.2 billion, or $1.52 a share, in the year-earlier period. Analysts were looking for $1.51 a share.

- Apple’s Greater China business drove $16.4 billion in revenue, down from $17.8 billion a year before, while analysts were looking for $15.3 billion.

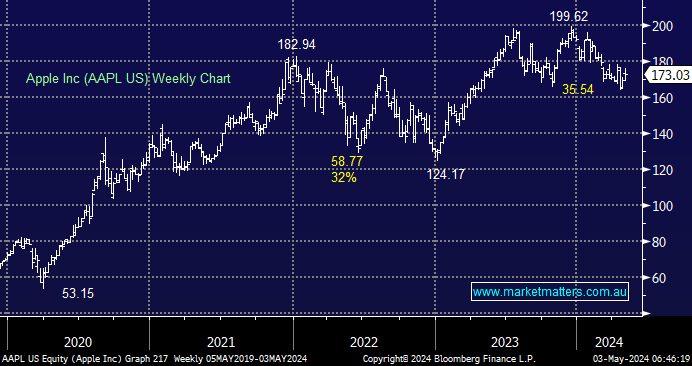

Apple’s shares traded up around 6% in the after-market, demonstrating the markets’ relief that the report wasn’t too bad. The initial move has the stock on track for its largest post-earnings gain since late 2022.

- We like Apple as a business, but we are considering alternatives after the great run we’ve enjoyed over the last five years – MM is long Apple Inc. in our International Companies Portfolio.