Hi Tony,

A very topical question after the Fed met this week. We believe that bonds are the pivotal piece of the puzzle which will determine if stocks can rally through 2024/5, i.e. if we are wrong and bonds fall/yields rise further the ASX200 will find it extremely hard to breach the psychological 8000 area any time soon.

The Fed left interest rates unchanged at 23-year highs this week, the sixth consecutive meeting with no change. Our view has not waivered through 2024 but the timing has indeed been tweaked:

- We felt markets were too optimistic towards rate cuts into 2024 (too dovish) with the futures market pricing in three rate cuts before Christmas, i.e. its dangerous to price any market for perfection.

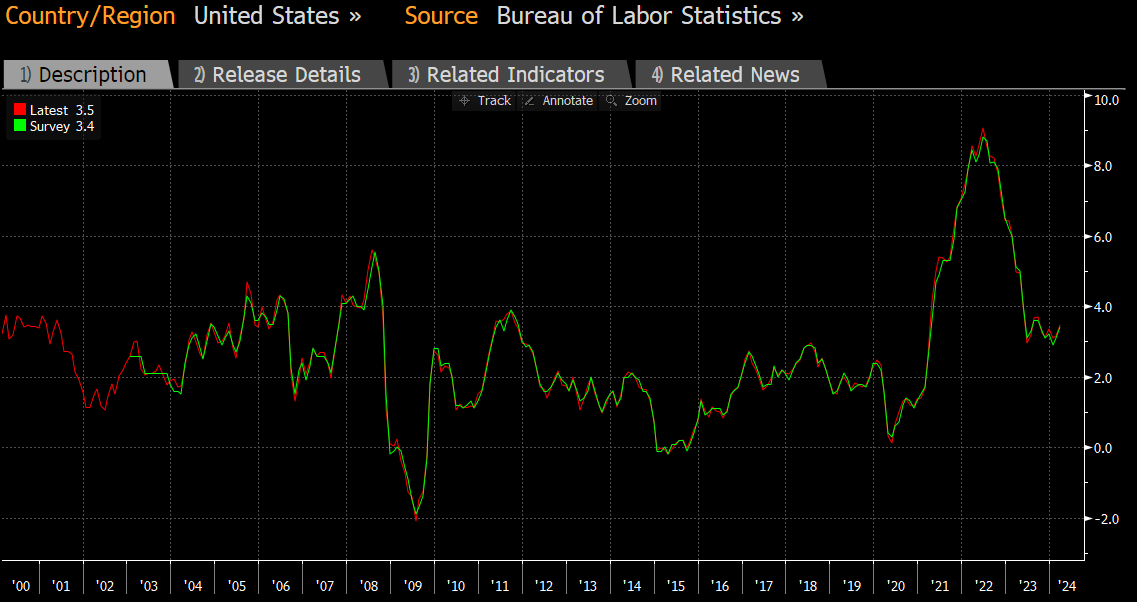

The Fed’s preferred inflation measure – the personal consumption expenditures price index – increased at a 2.7% annual rate in March, an acceleration from the prior month and well above their 2% target. The data led to Fed Chair Powell saying “Inflation is still too high,”. We like to say getting excessive inflation out of the economy is akin to squeezing juice out of an orange, with the last few drops by far the hardest.

- In terms of why we believe this, interest rates remain at restrictive levels according to the Fed yet the inflation picture has improved materially as the chart below shows, even if it’s become stickier recently. We are very confident interest rates will come down, the timing is just the issue.