US stocks rallied 0.9% overnight, although they surrendered 40% of their gains into the close as investors braced for the earnings numbers from the big tech stocks, starting with Tesla (TSLA US). The Dow posted its best day in 2-weeks, making it three up days in a row, as bonds finally stabilised ahead of a barrage of US quarterly earnings data over the coming days. Precious metals fell to 2-week lows as geopolitical tensions eased with weakness likely in the sector this morning.

- The S&P500 has been getting nervous, but an almost 10% drop in the VIX “Fear Gauge” overnight suggests stocks are entering the big tech reporting week in a more orderly manner.

- Our preferred scenario is that the S&P500 pushes to new highs over the coming months, but there are plenty of potential obstacles to navigate.

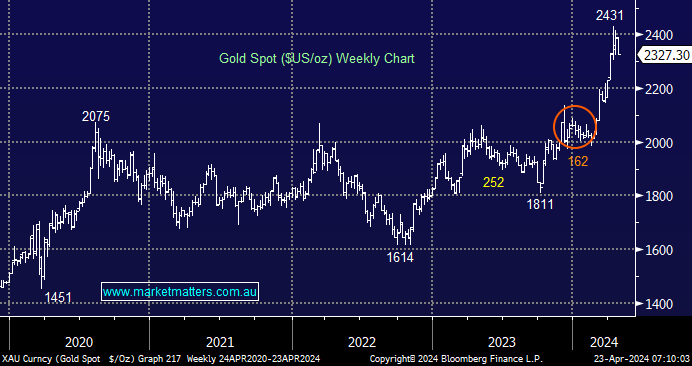

Gold and silver sold off on Monday as tensions in the Middle East eased, setting off waves of profit-taking, with silver tumbling over 5% in just one session. Also, less dovish interest rate expectations are weighing on precious metals, but we believe this will ultimately reverse later this year, reinstating a powerful tailwind to the sector.

- Gold is poised to consolidate recent gains in a similar fashion to the first 6 weeks of 2024; our pullback target is $US2,275/oz, or another 3% lower.