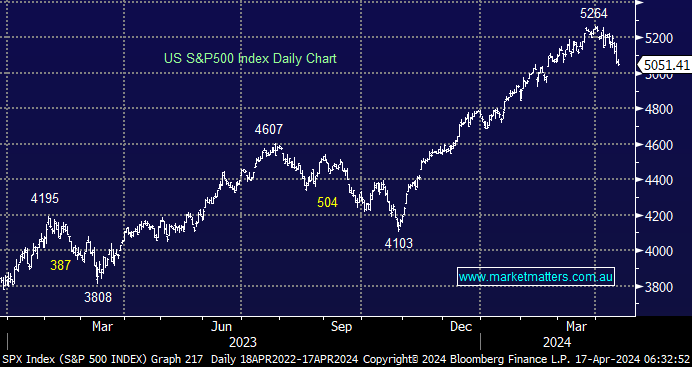

US indices experienced another mixed session overnight, with the S&P500 extending its recent pullback to 4%, a fairly controlled move considering the repricing that’s rolled through credit markets, e.g. the US 10s tested 4.7% last night following Powell’s comments after starting the year under 3.8%. The Dow managed to snap a 6-day losing streak overnight, but only just after United Health (UNH US) advanced +5.2% on the back of better-than-expected revenue, which outweighed Johnson & Johnson (JNJ US), which slipped 2.1%. In the banking sector, earnings reports drove a very mixed performance with Morgan Stanley (MS US) +2.5% while Bank of America (BAC US) slipped -3.5%.

- We are cautiously bullish around the S&P500 and US stocks, but the pullback we’ve been flagging is underway courtesy of bonds and the Middle East.

- With the US earnings season in full swing, investors’ attention is likely to return to the usual drivers of share prices, corporate performance.

Global stocks endured a tough Tuesday, and the Japanese market was no different. It fell 1.9%, testing 5-week lows in the process after surging to all-time highs in March, even after the BOJ hiked rates. The weak Yen, which is great for exports, has helped push the Nikkei higher, but the Land of the Rising Sun remains extremely dependent on imported oil, putting it in a vulnerable position as tensions escalate in the Middle East.

- We have been targeting a break below the 38,000 area over recent weeks, and our target area is now only 500-points away, or 1.5%, lower—not far now!

- We believe Japanese stocks are approaching an “accumulation zone”, a good read-through for the ASX.