The weakness across the Lithium Sector has lost its place in the financial press due to the strong rallies in copper and gold. Usually, more “clicks” are achieved from bad news and crash-style stories, but the lithium bear market has grown old in the tooth. However, as we’ve seen with other commodities and related stocks, this year is starting to look exciting for the commodity space, and we believe lithium can join the party, at least for a while. We aren’t as bullish towards lithium as copper, for example, with the supply & demand dynamics far from clear, but we can see them enjoying a strong finish to this FY.

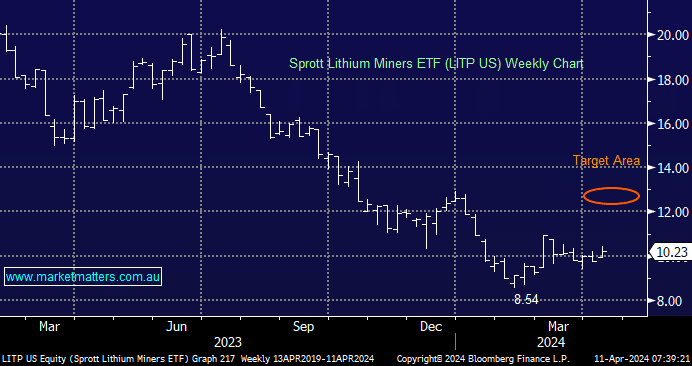

The sector enjoyed a small “squeeze” like move in early March, and we believe from a risk/reward perspective, there’s room for a similar advance in the relatively near future. One thing is for certain: this is a sector that has no correlation to the underlying market, having fallen sharply over recent quarters while equities rallied to new all-time highs. We know from our Q&A report on Saturday that many subscribers have a strong interest in this beleaguered sector; hence, we’ve revisited some prominent names as the commodities space “warms up”. However, we remain conscious that the sector is hostage to the underlying lithium price, which Goldman Sachs doesn’t believe will bottom until 2025.

NB: One of the reasons MM’s portfolios performed strongly in 2023 was that one of the core views was to step aside from the lithium miners; we have since reversed this stance and bought a number of plays into the sharp sell-off in early 2024.

- We remain short-term bullish towards lithium miners, initially targeting ~20% upside from current levels.

Below, we update our view of four major lithium miners, both from the US and locally.